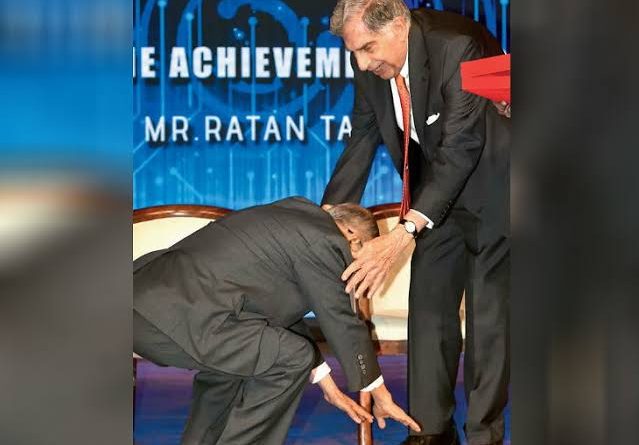

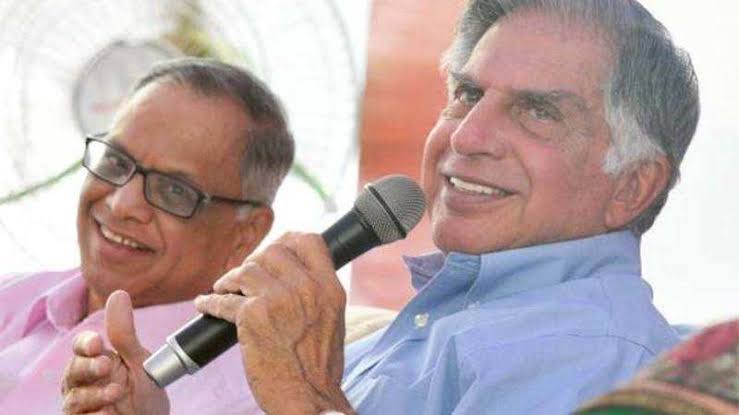

Tiecon Mumbai 2020: Ratan Tata gets Life Time Achievement Award, 73-year-old Narayan Murthy took blessings by touching Tata’s feet at 82

- Ratan Tata said- Startups that have disappeared by dipping investors’ money will not get a second chance, ethics is necessary in business.

- He said – old-fashioned businesses will gradually weaken, young founders of innovative companies will be the future leaders of Indian industry.

MUMBAI: Industrialist Ratan Tata was awarded the Tiecon Mumbai 2020 Life Time Achievement Award on Tuesday at the Tycon Award ceremony. The award was given to him by NR Narayana Murthy, the co-founder of the appraisal of Infasys in the corporate world. With this, he took Tata’s blessing by touching his feet. After this Ratan Tata warned that those startup investors who lose money by sinking will not get a second or third chance.

Ratan Tata’s statement comes at a time when many startups are facing allegations of cash burn. Cash burn refers to the way startups do business in which they continue to incur losses in the hope of making a profit in the future. This can be understood from the example of e-commerce company Flipkart. At one time, Flipkart was spending around a thousand crore rupees every month to expand its business.

Business ethics should be maintained

Tata said, “We will find startups that will attract attention. They will then collect the money and disappear. Such startups will not get a second or third chance. Tata, who has himself invested in e-commerce company Snapdeal, said ethics should be maintained in the business. The way to shine overnight should be avoided. He said that startups need guidance, advice, networking and recognition.

Pension funds and banks also invest in startups

Narayan Murthy, co-founder of Infosys, the country’s second largest IT company, said pension funds and banks should also invest in Indian startups. A positive environment for a startup cannot be created just on the basis of select investors. If more funds are to be raised for them, then pension funds and banks will have to come forward for investment.