Under what circumstances will the IRS mail you a second stimulus check even though you asked for direct deposit payment? | The State

The IRS began distributing the second coronavirus stimulus check last December.

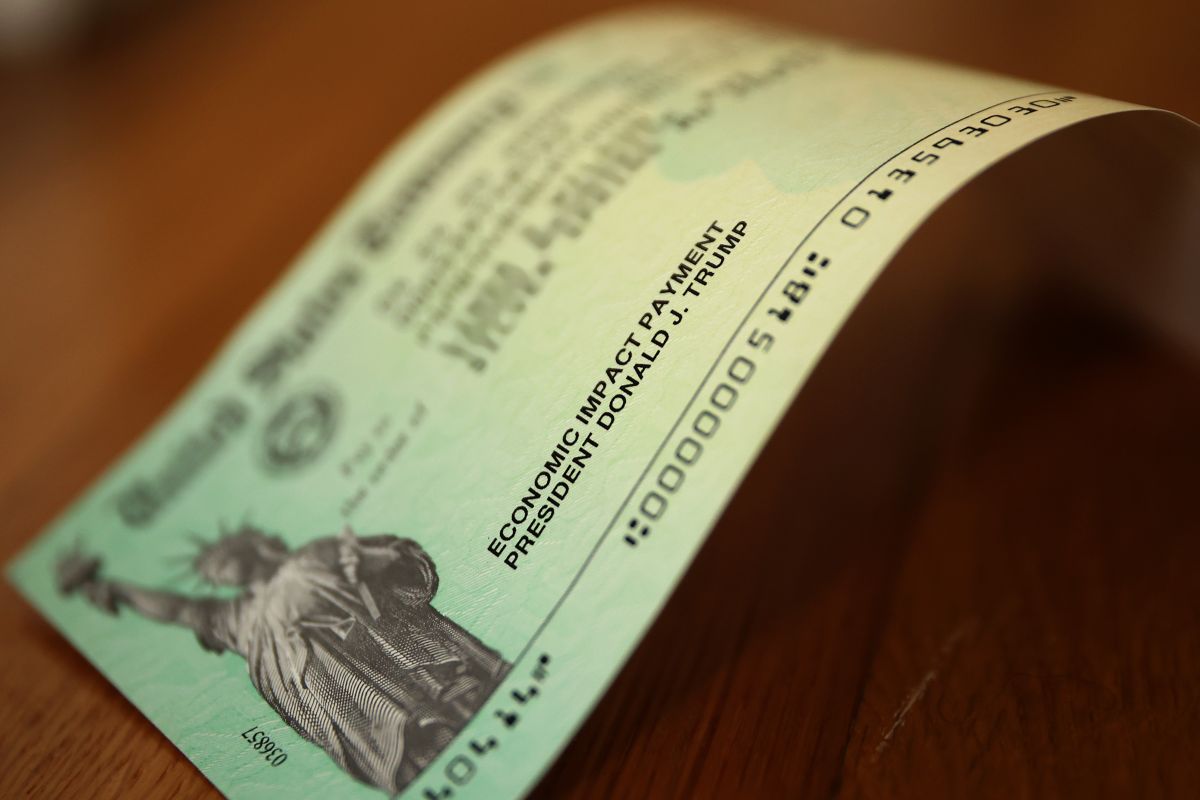

Photo:

Chip Somodevilla / Getty Images

Some beneficiaries of the second stimulus check of $ 600 approved last month in the United States Congress They have complained that despite having requested that the payment be deposited to their bank account, it was or would be sent by post.

He Internal Revenue Service (IRS) explained that there are at least two reasons why the stimulus check that you were expecting by direct deposit was sent through the United States Postal Service (USPS).

The first cause would be that your payment was already in process when the bank information was entered into the IRS system. A second cause that would explain the arrival of the paper check is that the bank rejected the deposit either because the bank information it provided to the agency appears invalid or the account is closed.

If you are eligible, you do not receive the second check or both, you can request the funds by filing this year in the form of a “Recovery Refund Credit”.

Should the IRS Online Tool “Get My Payment” specify that the payment was sent, but you never receive it, you must then choose a “fingerprint” or “payment trace”.

“Get My Payment” or “Get My Payment” It is a free service from the IRS through which you can verify the status of your “Economic Impact Payment”, if it has already been sent and by what means.

Given the possibility that under the new Joe Biden Administration a third stimulus check for $ 1,400 dollars is approved from the federal Congress as announced by the president, the authorities recommended requesting in the tax refund that the refund be deposited to a bank account. In this way, the chances that the stimulus check will arrive faster electronically are greater.

.