Fixed Deposit: Get attractive Interest rate up to 8.35% on this FD…

In a meeting held on February 5, 2020, the Monetary Policy Committee of the Reserve Bank of India has decided to keep the repo rate unchanged at 5.15%. However, with the announcement of some new measures, it was also decided to reduce the interest rates. Continuing the same repo rate for a long time is one of these measures, which will open an additional gate of Rs 1 lakh crore, where finance will be provided by the RBI at a repo rate of 5.15% for 1 year and 3 years. However it is lower than the Fixed Deposit rates of current rates in the market for a period of 1 year and 3 years. Although this reduces the cost of funding for banks and corporates, it will not be in the interest of retail bank depositors. Hence FD rates are expected to be lower.

Why should you invest in a fixed deposit?

Despite falling interest rates, FDs remain a better investment option under current economic conditions. If you are considering the means of investment market, then it is important to know that while the domestic market has seen a historic change after the 2020 budget announcement, the market fluctuations will soon be back on track. The government can also potentially reduce the interest rates on small savings schemes, which will make the option of fixed deposits the best for you.

However, in view of falling interest rates, it has become challenging to get excellent returns on your deposits. In fact, to take full advantage of a fixed deposit, it is important to choose the right company. In this sense, Bajaj Finance Fixed Deposit is a particularly notable option, because here you get to offer the highest attractive interest rates on FDs in the industry, ie up to 8.35% and you can raise your funds almost without any risk. Gives opportunity. Read further to understand this very well, how Bajaj Finance FD is the right choice to get 8% and above returns.

Get a better rate of interest than other companies…

As a new customer, you get an interest rate of up to 8.10% by investing in Bajaj Finance FD, as well as an existing customer or employee of Bajaj Finance you get an interest rate of 8.20%, while as a senior citizen you You can avail an interest rate of up to 8.35%, but for this you have to take a FD of at least 36 months in which the return has to be paid at maturity. Ideally choose a long-time FD to get the highest return, as it gives you the opportunity to increase your income through compounding interest. Actually, you can get up to 49.32% return on taking Bajaj Finance FD for 5 years, which depends on your investor portfolio.

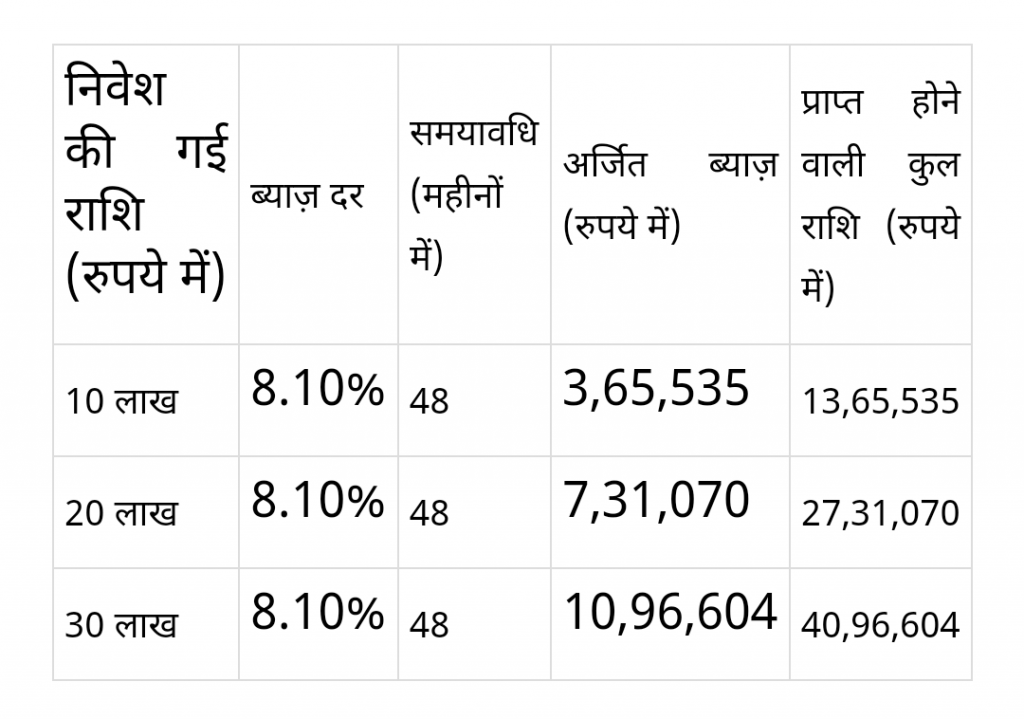

Take a look at the table below, so that you as a new customer can assess the interest and total income earned on investment of Rs 10 lakh, Rs 20 lakh and Rs 30 lakh over a period of 4 years:

Select the time period according to your convenience

When you choose Bajaj Finance FD then you can choose to invest for a period of 1 to 5 years as per your convenience. Thus, you can use your accumulated capital very wisely, as well as use the income from investments to achieve both short-term and long-term goals. However, to get a return of at least 8%, consider investing for at least 36 months, in which interest is to be paid at maturity. Always keep in mind that investing for a long period gives higher returns in the form of interest and hence is the best option to increase your funds. Use the FD calculator to plan it most effectively, so that you can estimate your income accurately.

Maximum stability and reliable rating

Bajaj Finance has the highest stability rating of MAAA and FAAA from CRISIL and ICRA respectively, which guarantees the security of your deposit. Also, it is the only NBCF in the country which has got an international rating of ‘BBB’ from S&P Global. Also, this gives you the assurance that you will definitely get returns as market fluctuations on FDs are not affected. So take advantage of this highly secure and reliable means and invest sufficient funds in long-term FDs. In this way, you can earn a lot on the basis of compounding interest without worrying about any lapse.

Facility of SIPs with assured returns

Generally, to book an FD you need a large amount of money, as it involves a lump sum investment. However, with Bajaj Finance’s Systematic Deposit Plan (SDP), you can easily start your investment by making a medium-sized monthly deposit starting at Rs 5000. Here you can make a monthly deposit from 6 to 48 and choose the period from 12 to 60 months as per your convenience. Each deposit is considered a separate FD and the period chosen for the first deposit applies to all. Not only this, every new FD is booked at the prevailing interest rate on the day you deposit so that you can earn higher rates when the market is favorable.

Thus, Bajaj Finance FD is the best in providing returns of 8% and above. For greater ease you can also opt for multi-deposit facility and easily proceed on your investment journey with just one check. So get ready immediately and fill your property without any hassle by filling the online application form to book your FD.