GameStop's three largest shareholders have gotten $3BILLION richer in two weeks

The Reddit subgroup fueling the unprecedented surge of GameStop shares in a campaign that is rattling Wall Street, was briefly made private shortly after its users were kicked off gamer messaging app Discord due to hate speech violations.

Discord on Wednesday confirmed it has banned the r/WallStreetBets server from its platform, where thousands of users had shared messages hyping up GameStop’s stock and urged other investors to hold on to their shares or buy more.

The campaign effectively sent the company’s shares up 1,700 per cent in four weeks, with three of its largest individual investors gaining more than $3 billion in net worth during the stock’s staggering rally.

The extreme volatility raised concerns about manipulation which could lead to an investigation by stock market regulators, and has even drawn attention from the White House.

Discord however, said the channel was not removed due to fraud but for ‘continuing to allow hateful and discriminatory content after repeated warnings.’

Discord, a messaging platform for online gamers, announced it has removed Reddit’s WallStreetBets server from its platform for violating its guidelines on hate speech and spreading misinformation

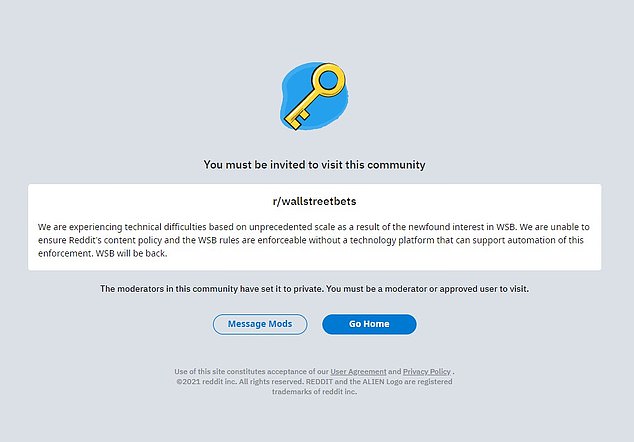

Shortly after, the r/wallstreetbets subreddit was made private by the group’s moderators

The company said the channel had been on their radar ‘for some time’ due to content violations and had issued multiple warnings to the server admin before banning it.

‘To be clear, we did not ban this server due to financial fraud related to GameStop or other stocks,’ Discord said in a statement.

‘Discord welcomes a broad variety of personal finance discussions, from investment clubs and day traders to college students and professional financial advisors.

‘We are monitoring this situation and in the event there are allegations of illegal activities, we will cooperate with authorities as appropriate.’

Shortly after the server was banned, the WallStreetBets subreddit was made private by the group’s moderators.

Access to the page was restricted to members only, however, some longterm subscribers claimed on social media that they had been booted off the page as well.

Moderators later addressed the blockage on their Twitter account, saying they were working to get the page back up and running.

‘Due to the in tents load the sub was put under today from our explosive growth the mod team has been working behind the scenes to get r/wallstreetbets back up. Please [bear]with us during this trying time,’ they said in a tweet.

Earlier, the White House and Securities and Exchange Commission said they are monitoring the situation after Reddit users led by a YouTube financial guru known as ‘Roaring Kitty’ sent shares in GameStop up another 130 percent on Wednesday, costing hedge funds billions and prompting the CEO of the Nasdaq Exchange to propose a trading halt.

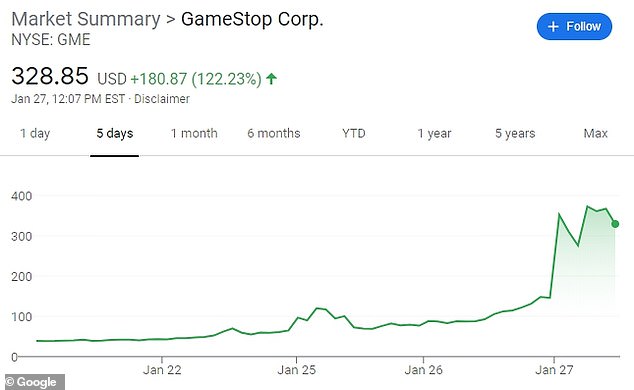

The Reddit group WallStreetBets has been driving up GameStop’s share price, which closed at $347.51 on Wednesday after starting the month at $17.25, by betting against Wall Street short-sellers who expected the firm to collapse.

YouTuber ‘Roaring Kitty’ has been one of the key cheerleaders of the GameStock rally

It is a battle that pitted small investors using free trading apps such as Robinhood against several massive hedge funds, which had taken out large short positions on the assumption that GameStop’s stock would go down.

Millions of Redditors have pursued a strategy known as a ‘short squeeze’, in which a price rally forces short sellers to buy up more shares. The GameStop surge has inspired copycats to pursue the strategy with heavily shorted theater chain AMC, which saw share prices soar 260 percent on Wednesday.

Professional Wall Street investors are shaken by the bizarre speculative rallies, warning that the bubble that could collapse at any moment, wiping out the gains of the biggest shareholders and small investors alike.

After markets closed on Wednesday, the SEC released a statement on ‘ongoing market volatility,’ saying it is working with ‘fellow regulators to assess the situation and review the activities of regulated entities, financial intermediaries, and other market participants’.

The Biden administration has said they are ‘monitoring’ the flurry of trading action and a growing number of state regulators are calling it dangerous.

Nasdaq CEO Adena Friedman told CNBC on Wednesday morning: ‘If we see a significant rise in the chatter on social media … and we also match that up against unusual trading activity, we will potentially halt that st

ock to allow ourselves to investigate the situation.’

However GameStop is listed on the New York Stock Exchange, not the Nasdaq.

GameStop shares rose another 120 percent on Wednesday extending the rally fueled by the Reddit group WallStreetBets, which urged a buying campaign

Nasdaq CEO Adena Friedman told CNBC on Wednesday morning: ‘If we see a significant rise in the chatter on social media … and we also match that up against unusual trading activity, we will potentially halt that stock to allow ourselves to investigate the situation.’

Reddit users are piling into the stock in part to punish big hedge funds that shorted it

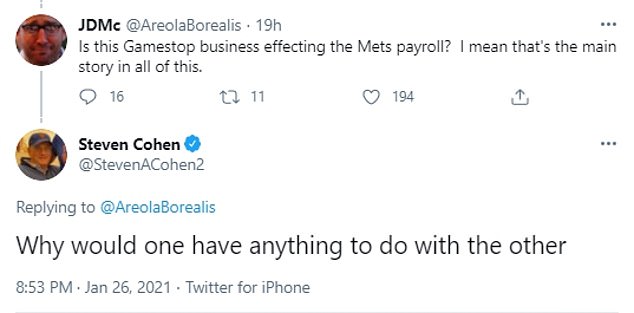

New York Mets owner Steve Cohen had exposure to the turbulent situation as well, after his Point72 Asset Management helped bail out Melvin Capital

On the losing end of the recent price action have been a number of hedge funds, who had heavily shorted GameStop stock, betting that the share price would fall.

Hedge funds Citron and Melvin Capital said on Wednesday that they had closed out their short positions after suffering undisclosed losses, likely totaling in the billions.

Short selling is a way of making money off a stock if the share price goes down, and GameStop had been one of the most shorted stocks on the market when the Reddit group targeted it.

Citron founder Andrew Left has called the Reddit cheerleaders of GameStop an ‘angry mob’, and recently stopped covering the stock in his research letter, saying he had been harassed by the forum users.

Melvin Capital, the $12.5 billion hedge fund founded by Gabriel Plotkin, was one of the main targets of the Reddit campaign, after an SEC filing revealed that the fund had a large short position in GameStop.

‘By the end of the week (Or even the end of the day), Plotkin is going to have less than a college student 50k in debt who works part time at starbucks,’ one Reddit user wrote on Wednesday morning.

New York Mets owner Steve Cohen had exposure to the turbulent situation as well, after his Point72 Asset Management teamed up with Ken Griffin’s firm Citadel to inject Melvin with a combined $2.75 billion bailout on Monday to help the struggling fund.

Responding to a worried Mets fan on Twitter who asked if the GameStop situation would impact the team’s payroll, Cohen wrote: ‘Why would one have anything to do with the other’.

Maplelane Capital LLC, a New York hedge fund that started the year with about $3.5 billion, was down roughly 30 percent for the year through Wednesday, with its bearish GameStop position a significant driver of losses, sources told the Wall Street Journal.

GameStop’s largest individual shareholder, Ryan Cohen, has seen his 13 percent stake increase in value by more than $2 billion over the past two weeks. The Chewy co-founder, who joined GameStop’s board this month, originally paid about $76 million for the stake and has seen his net worth increase by about $6 million per hour over the past two weeks.

Meanwhile, investor Donald Foss, the former CEO of a subprime auto lender, has seen his 5 percent stake increase by about $800 million, and GameStop CEO George Sherman’s 3.4 percent stake is up about $500 million.

GameStop’s largest individual shareholder, Ryan Cohen, has seen his 13% stake increase in value by more than $2 billion over the past two weeks, or more than $6 million an hour

Investor Donald Foss (left), the former CEO of a subprime auto lender, has seen his 5 percent stake in GameStop increase by about $800 million, and GameStop CEO George Sherman’s (right) 3.4 percent stake is up about $500 million

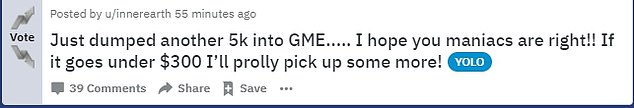

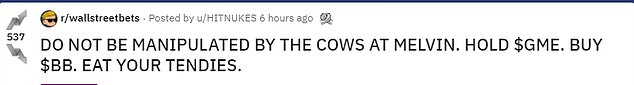

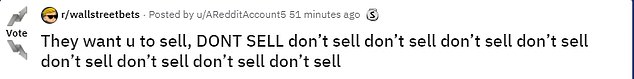

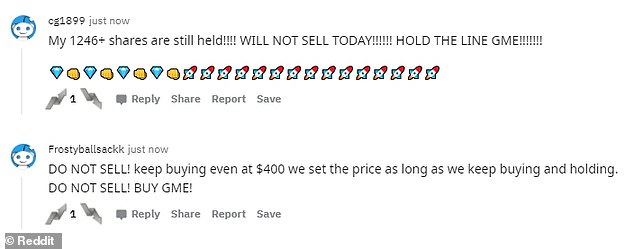

Users of the Reddit forum WallStreetBets have been urging each other to buy and hold GameStop stock, driving the price higher, as seen above on Wednesday

In addition to the individual stakeholders, BlackRock, the world’s largest asset manager, could have made gains of about $2.4 billion on its investment in GameStop.

The asset manager owned about 9.2 million shares, or a roughly 13 percent stake, in GameStop as of December 31, 2020, a regulatory filing showed on Tuesday.

Assuming no change in BlackRock’s position, the value of its stake would be worth $2.6 billion now, compared with $173.6 million as of December.

As the price surge continued on Wednesday, TD Ameritrade issued an alert to its users saying that it had ‘put in place several restrictions on some transactions’ in shares of GameStop and theater chain AMC, another heavily shorted stock that skyrocketed overnight.

A spokeswoman for TD Ameritrade did not immediately respond to a request for more information from DailyMail.com on Wednesday.

Overall, the main stock indexes were down on Wednesday, with some market watchers blaming the speculative frenzy for shaking investor confidence.

White House Press Secretary Jen Psaki said on Wednesday that President Joe Biden’s team is ‘monitoring the situation’ with GameStop.

Senator Elizabeth Warren, a Massachusetts Democrat, weighed in calling for more regulation. ‘With stocks soaring while millions are out of work and struggling to pay bills, it’s not news that the stock market doesn’t reflect our actual economy,’ she said.

‘For years, the same hedge funds, private equity firms, and wealthy investors dismayed by the GameStop trades have treated the stock market like their own personal casino while everyone else pays the price,’ Warren added.

‘It’s long past time for the SEC and other financial regulators to wake up and do their jobs – and with a new administration and Democrats running Congress, I intend to make sure they do,’ she said.

The top securities regulator in Massachusetts believes trading in GameStop stock suggests there is something ‘systemically wrong’ with the options trading around the stock.

Jacob Frenkel, Securities Enforcement Practice chair for law firm Dickinson Wright, said the SEC would likely look at whether the messaging by investors holding the stock long-term and activists betting against it was manipulative.

‘With federal prosecutors having become much more sophisticated in their cases over the years on securities trading … it is reasonable to believe that any SEC investigation could well have a parallel criminal investigation,’

Others say that the trades are up to the investors who make them, at the end of the day.

‘That’s the sentiment, the public doing what they feel has been done to them by institutions,’ Reddit co-founder Alexis Ohanian said in a tweet on Wednesday.

GameStop shares are up 1,700 percent since the beginning of the month in a staggering rally

TD Ameritrade issued an alert to its users saying that it had ‘put in place several restrictions on some transactions’ in shares of GameStop and theater chain AMC

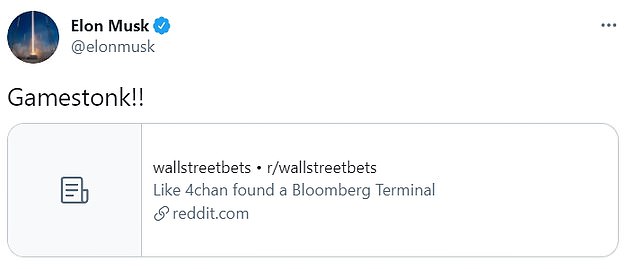

GameStop shares were boosted on Tuesday by Elon Musk, who tweeted ‘Gamestonk!!’ along with a link to Reddit’s WallStreetBets stock trading discussion group, where supporters affectionately refer to the Tesla CEO as ‘Papa Musk’.

‘Stonks’ is a tongue-in-cheek term for stocks widely used on social media.

The small investor

s on Reddit, many using free trading apps such as Robinhood, have been buying GameStop stock at high volumes to drive the price up, and forcing panicked hedge funds with short positions to buy shares of their own to cover their short positions, further fueling the surge.

It is a risky strategy that could collapse at any time, but posters on the Reddit forum indicated on Wednesday morning that their buying campaign would continue.

Many of the comments indicated that the Reddit users participating in the campaign reveled at the prospect of destroying hedge funds that had bet against GameStop, as well as the prospect of making ‘gains’ if the share price continues to rise.

Little is known about the YouTuber Roaring Kitty, who has been posting videos for several months analyzing options trading of GameStop and proposing that the stock was ripe for a short squeeze.

His calls evolved into a passionate mass movement that members of WallStreetBets seem to have embraced with an almost religious furor, vowing that they will either ‘ride’ GameStock to $1,000 or all the way to zero.

GameStop’s extraordinary price action has been the talk of Wall Street this week, and is raising questions about potential regulatory clampdowns from the US Securities and Exchange Commission (SEC).

GameStop’s shares skyrocketed for a fourth straight day, thanks in part to Elon Musk’s Tuesday afternoon tweet

The company surged 50 per cent in extended trade Tuesday after Musk tweeted ‘Gamestonk!!’ ‘Stonks’ is a tongue-in-cheek term for stocks widely used on social media

With commentators and lawyers calling for scrutiny of the moves, Nasdaq chief Adena Friedman said exchanges and regulators needed to pay attention to the potential for ‘pump and dump’ schemes driven by chatter on social media.

‘If we see a significant rise in the chatter on social media … and we also match that up against unusual trading activity, we will potentially halt that stock to allow ourselves to investigate the situation,’ Friedman said, asked on CNBC about the issue after the exchange’s annual financial results.

‘If we do think or contemplate that there may be some manipulation, we then engage with FINRA and the SEC to evaluate and investigate that.’

The Securities and Exchange Commission (SEC) declined to comment on the proposal. Gamestop and AMC are both listed on the New York Stock Exchange.

Mainstream commentators have questioned the justification of moves in several Reddit-hyped stocks in recent days, at a time when some on Wall Street are wondering if months of stellar overall gains have driven shares more generally into bubble territory.

The surge in recent days – GameStop (file image) has increased more than seven-fold to $147.98 from $19 since January 12 – has spurred concerns over bubbles in stocks that hedge funds and other speculative players had bet would fall in value

‘These are not normal times and while the (Reddit) … thing is fascinating to watch, I can’t help but think that this is unlikely to end well for someone,’ Deutsche Bank strategist Jim Reid said.

Easy access apps like Robinhood, which allow ordinary Americans to make stock market trades at almost no initial cost, have spurred a boom in direct investment over the past year as trillions of dollars in official stimulus drove markets higher.

On GameStop, the retail army have pitched themselves against some of the institutional short-sellers – a traditional area for hedge funds – who promote and bet on falls in companies they judge as weak.

The 20 small-cap Russell 2000 index companies with the biggest bearish bets against them have risen 60 percent on average so far this year, easily outperforming the rest of the market, a Reuters analysis of Refinitiv data shows.

Early on Tuesday, short sellers in GameStop were down $5 billion on a mark-to-market, net-of-financing basis in 2021, according to analytics firm S3 Partners.