IRS: The Reasons You Have Not Received Your Second Stimulus Check And Actions To Claim Payment Yet | The State

Some Americans still do not receive the first stimulus check when agencies are already handing out the second.

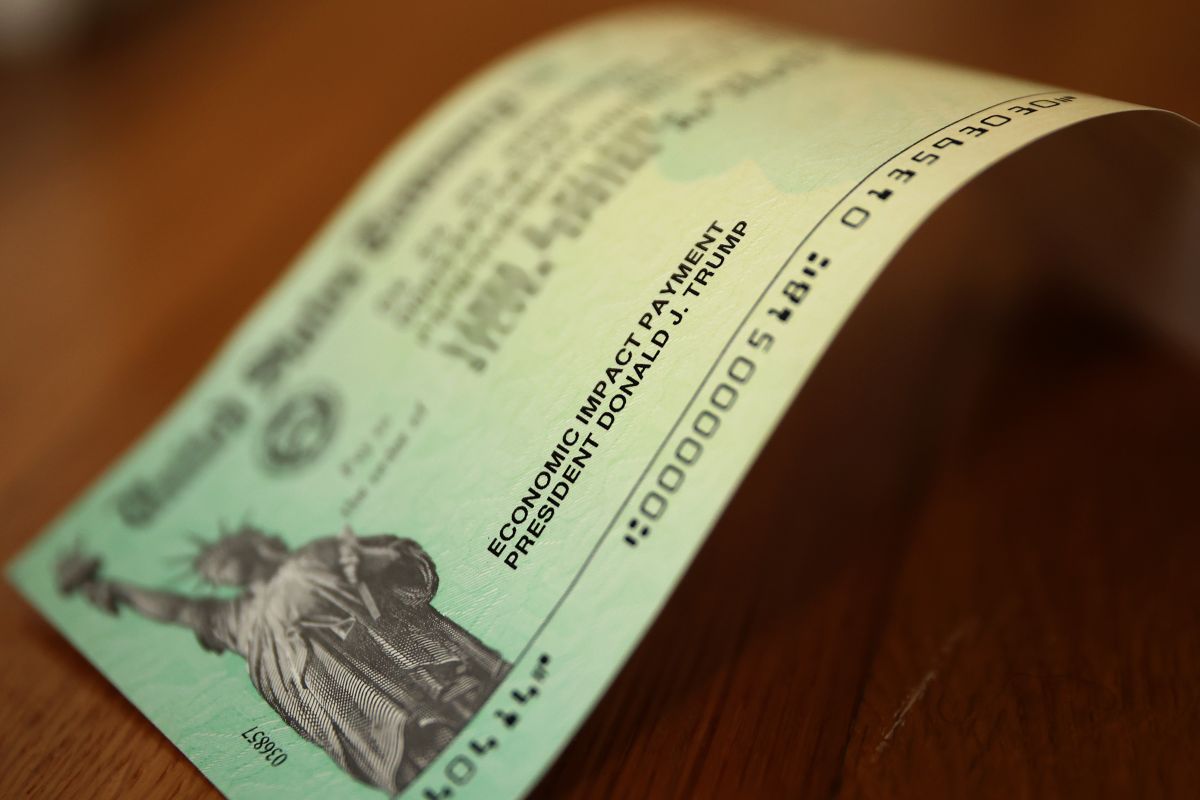

Photo:

Chip Somodevilla / Getty Images

Next January 15 is the date stipulated by law for the Internal Revenue Service (IRS) in coordination with the Treasury Department complete the mailing of most stimulus checks for the second round.

Government authorities have indicated that if the persons eligible for the payment have not received it by that day, they must request it in a tax return during the upcoming tax season. through a “Refund Recovery Credit”.

One of the main causes for a beneficiary not to receive the money that corresponds to him under the Supplemental Appropriations in Response and Relief to Coronavirus Act of 2021, approved in December in the United States Congress, is not having declared taxes.

The IRS bases the processing of stimulus checks primarily on the taxpayer information on file to establish the appropriate payment and thus process the shipment. In the first round of payments, millions of people did not receive the payment of which they were creditors because the IRS did not have their personal information.

The tool “Non-filers” It was enabled last spring for Americans eligible for the stimulus check to submit their information to the IRS so they can process the shipment. But the service is no longer available from November 21.

Now, the option that remains for people who did not receive the first and second checks is to request, or one of these, is to request the same as a tax credit on the return.

Aside from not having filed taxes for the past few years, at least six other circumstances could prevent you from receiving the “Financial Impact Payment” automatically.

Here are the possible causes:

1. Your 2019 tax return has not been processed

If you submitted your paper tax return, it could be among the returns not yet processed by the IRS. The agency accumulates millions of pieces of paper that could not be examined last year due to the coronavirus emergency and the closure of offices. This has even caused delays in tax refund shipments. Remember that to determine the amount of the stimulus check, the entity does it based on the income it reports. If the IRS has not verified your tax information, you will most likely receive your corresponding stimulus checks outside of the specified date.

2. The check is on its way

The IRS may already have processed your payment, but it is en route through the postal system.

There are three days left until the January 15 deadline is met, so there is a possibility that it will arrive soon.

If you did not provide the agency with your bank account information for direct deposit of the money, it will arrive by mail either by debit card or paper check.

It is likely that if you do not receive the money electronically to your account, the IRS has had to process it in one of the above ways, and this makes the money take longer to arrive.

3. You have a new bank account

If you set up a new bank or credit union account and the IRS does not have information about the change, you will experience delays in the arrival of the money. The agency uses the data in its files. But if an account was closed because you have a new one, the financial institution will return the funds to the IRS. In these cases, the office may mail you a paper check. But if that doesn’t happen, you will need to apply for the “Recovery Refund Credit”.

4. Problems with tax preparation companies

Companies like TurboTax and H&R Block they alerted their clients to delays in disbursement of stimulus funds because the IRS deposited the money in a temporary account and not the taxpayer’s. In some instances the IRS was supposed to correct the error and redirect the money to the appropriate account. If that does not happen, you will need to contact the preparing company for next steps. But, most likely, you will need to request the payment due along with your tax return.

5. You are undocumented and are not married to a person who is a citizen

The approved statute provides for undocumented persons married to spouses who have permission to be in the country to also receive the funds.

As part of the first round of payments of $ 1,200 under the CARES Act, this group – both the person with documentation and the person without – were excluded from aid. In other cases, foreigners without legal documentation will not receive the aid.

6. You are simply not eligible

It seems like an obvious cause, but it is not. Many people do not pay attention to the income eligibility requirements (AGI) for stimulus checks and lose sight of the fact that they do not have the criteria to qualify for the payment. The law establishes that they are eligible to receive the financial aid, the single ones that earn $ 87,000 annual dollars or less; while in the case of couples filing jointly, they must generate no more than $ 150,000.

.