Why won't you get a second stimulus check if you reported a lot of income to the IRS | The State

The AGI is related to the issuance of the second stimulus check.

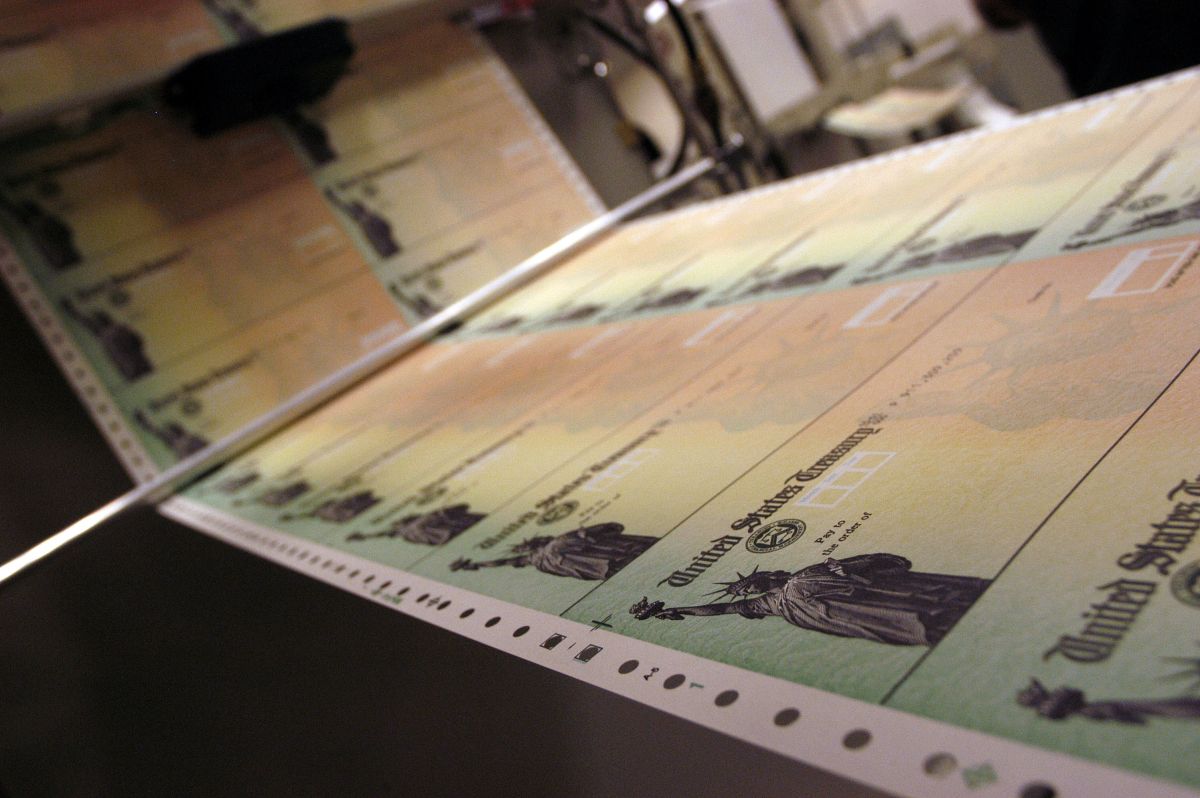

Photo:

Thomas Cain / Getty Images

This Monday, January 4, the second stimulus check of $ 600 dollars began to be sent so that people can face the crisis caused by the coronavirus. However, there is a group of people who will receive absolutely no money, and all for having a good income.

The amount of your stimulus check is tied to your adjusted gross income (AGI), which would be the amount of money you earned in one year and that you reported to the IRS.

If your adjusted gross income is $ 75,000 or less (or $ 150,000 for married couples), you will receive the full payment of $ 600. But, if your AGI goes over that limit, you’ll get a second, smaller stimulus check. In fact, the amount of money will be reduced by 5% for every dollar you earn above $ 75,000 (or $ 150,000 for married couples).

This means that people without dependents earning $ 87,000 or more (or married couples earning $ 174,000 or more) will receive nothing from the second stimulus check, as reported in Money.

–You may also be interested in: What to do if your stimulus check is deposited in the wrong bank account

.