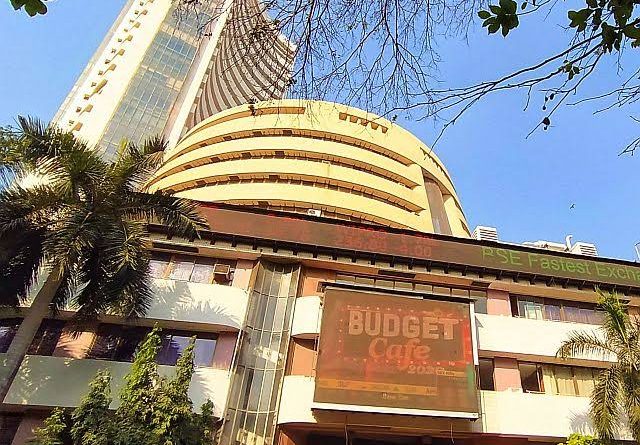

Sensex drops 988 points, history’s biggest decline on budget day; 3.46 lakh crore loss to investors

- The biggest fall of the past 11 years, the Sensex had dropped 1070.63 points on October 24, 2008.

- Long-term capital gains tax relief was expected, but investors were disappointed with no announcement about it.

Mumbai: Trading took place in the stock market despite Saturday due to the budget. The Sensex lost 987.96 points to close at 39,735.53. The loss of the Sensex resulted in a loss of Rs 3.46 lakh crore to investors. This is the biggest decline in the Sensex in terms of numbers in the history of the budget so far. This is also the biggest decline in the last 11 years. Earlier on 24 October 2008, it had dropped by 1070.63 points. On Saturday, the Nifty also closed down 300.25 points at 11661.85. Sensex fell by 279 points in early trade. It rose by 182 points to 40,905.78 in intraday.

3.46 lakh crore loss to investors

There was tremendous disappointment among the investors due to non-expected announcements in the budget. Investors lost Rs 3.46 lakh crore amid heavy selling. The Reality Index declined 8%, the Capital Goods Index declined 4.75%.

According to analysts, 5 reasons for market decline:

- Long-term capital gains tax relief was expected. Frustration in the market with no announcement on this.

- The government estimates a nominal GDP growth of 10%, with analysts finding it too high.

- To save IDBI Bank, the government is silent on disinvestment in PSU bank.

- LIC has announced an IPO. That is, the government will reduce its stake in LIC.

- Relief was also expected for the real estate sector. However, no major announcement was made.

Last year, the government increased the surcharge on super rich, later reversed the decision

Announcements for sector-specific companies on the Budget day have an impact on the stocks of sector-specific companies. The budget was presented on 5 July last year. The Sensex had lost 1% on that day and the Nifty 1.14%. In the last budget, Finance Minister Nirmala Sitharaman had announced to increase the surcharge on super rich. Foreign investors were also considered within its purview. This had led to a decline in the market. However, the government withdrew the surcharge hike a few days later.