What do you need to do to receive the second $ 600 stimulus check from the IRS? | The State

The method of payment for the second stimulus check may be different from the first.

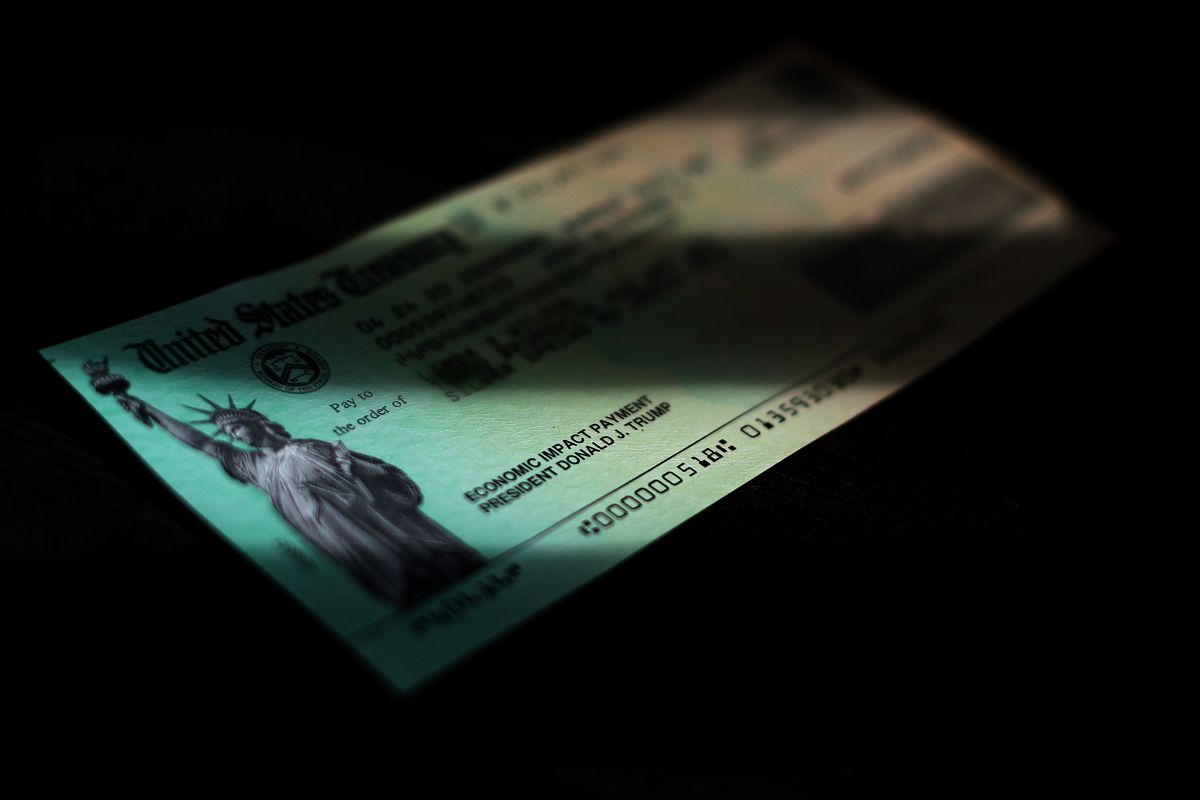

Photo:

Chip Somodevilla / Getty Images

The Internal Revenue Service (IRS) has insisted that taxpayers who are eligible for a tax are not required to receive the second stimulus check take no action.

The initial direct deposit payments began to arrive on the night of Tuesday, December 29 and will be made until next week, as reported by the Secretary of the Treasury, Steven Mnuchin, while paper checks were sent as of Wednesday, December 30.

The economic stimulus check is part of the Coronavirus Relief and Response Supplemental Appropriations Act that was passed by Congress last week and signed by the President. Donald trump Sunday night.

Some people may see direct deposit payments in pending status or as interim payments to their bank accounts before the official payment date of January 4, 2021, paper checks may have a later date. It does not matter if the payments are direct deposit or paper checks they are automatic.

There is no formula to determine the arrival date of each of the checks. The IRS has reminded taxpayers that don’t get in touch Contact your financial institutions or the IRS with questions about the payment date.

Payments received for the second stimulus check for eligible taxpayers who filed a tax return in 2019, those who receive Social Security Retirement or Disability (SSDI) benefits, Railroad Retirement benefits, as well as beneficiaries of the Supplemental Security Income (SSI) and Veterans Affairs who did not file a tax return. If this is your situation and for some reason you do not receive a payment, you can claim your money when you file a tax return for the year 2020.

Payments will also be automatic for anyone who has successfully registered for the first online payment on the IRS website using the “Non-Filers” tool until November 21 of last year or who has filed a tax return. that has been processed by the IRS.

Eligible individuals will receive checks up to $ 600 dollars for single people and $ 1,200 dollars for married couples and up to $ 600 for each qualifying minor. The amount of the checks will begin to decrease progressively for those who earn more than $ 75,000 dollars, $ 150,000 dollars for joint returns and $ 112,500 for heads of household.

In the same way as the delivery of the first stimulus check, financial dependents over 17 years of age are not eligible to receive child pay. Many people think that there was a change in the eligibility of dependents but this did not happen. To know the eligibility criteria you can find additional information on the IRS website.

Related: Which group of people will receive the second $ 600 stimulus check first?

What will the payment of the second stimulus check be like?

Much like the first round of stimulus checks, most people will get paid by direct deposit. Social Security and other beneficiaries who received the first round of stimulus checks through Direct Express will receive this second payment in the same way.

If you have not received the direct deposit stimulus payment, you will likely receive a check or in some cases a debit card.

The IRS noted that the form of payment for the second stimulus check may be different than the first. Some people who received a paper check during the first delivery might receive a debit card this time and some people who received a debit card the last time could receive a paper check.

You may be interested:

.