We tell you the cases in which you must return your second stimulus check to the IRS | The State

There is a simple procedure for returning the check to the IRS.

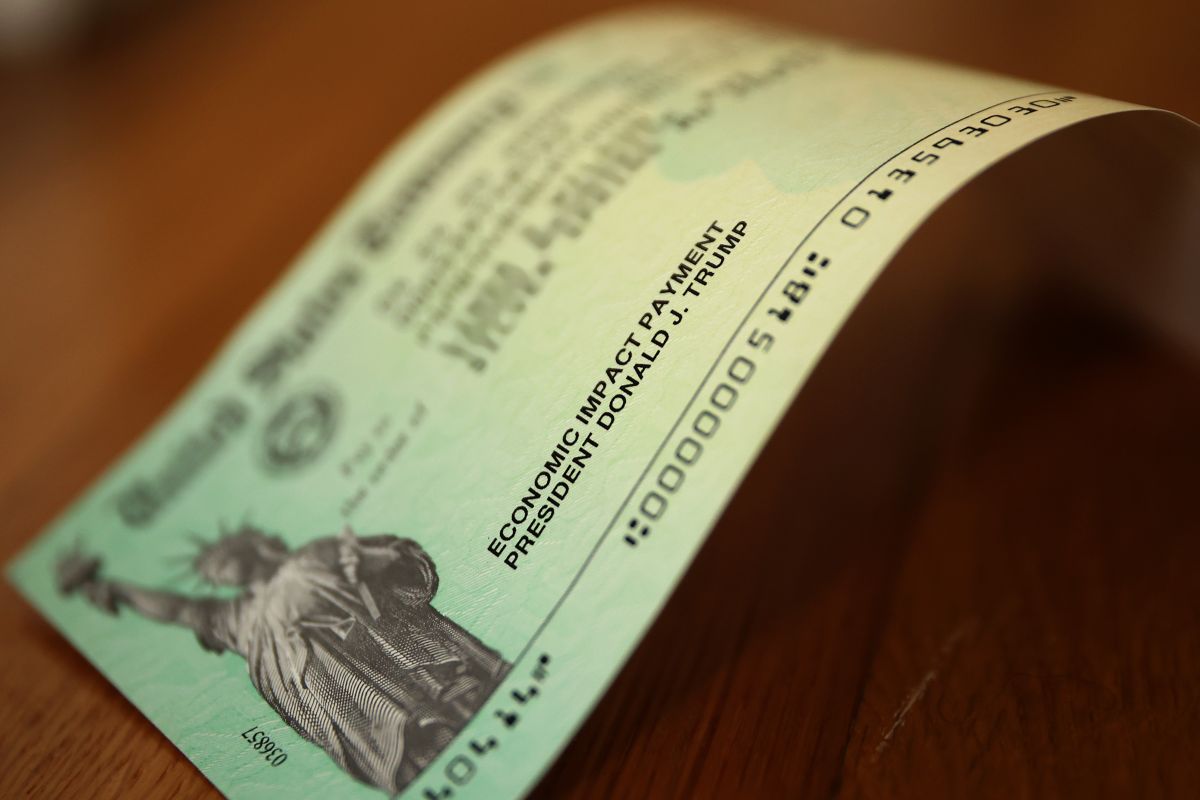

Photo:

Chip Somodevilla / Getty Images

In the rush to meet the January 15 deadline to automatically submit second $ 600 stimulus checks, the IRS may have made a mistake sending the money to some people who didn’t actually qualify.

So if you fall into any of the following categories and received a stimulus check, it is very likely that you received it in error and should return it to the IRS, as reported by CNET.

These cases would be the following:

“You received a stimulus check made out to someone who died.”

–You don’t have a social security number.

–You are considered a “non-resident alien” and your spouse is not a US citizen.

–Your adjusted gross income (AGI) exceeds the limit. For example, if you made more than $ 87,000 and are filing single tax returns, you shouldn’t get the check.

–Another person claims you as a dependent on their tax return.

If you are in any of the above situations, you may need to return the stimulus check. For this, you must do the following:

1. Write “VOID” in the endorsement section on the back of the check.

2. Do not fold, clamp, or staple the check.

3. On a separate sheet of paper, tell the IRS why you are returning the check.

Four. Mail the check to the appropriate IRS location. Remember that this varies depending on the state in which you live.

-You may also be interested in: People keep throwing away stimulus checks despite IRS warning

.