Double dip recession on the way: Lockdown 3 set to cost us £390m a day after Britain shuts up shop

The UK faces plunging into its first double-dip recession since 1975, with the latest lockdown expected to cost almost £400million per day.

Output in the first quarter of this year will be £24.57billion lower than it would have been without the third national lockdown, a think-tank warned yesterday.

The Centre of Economics and Business Research (CEBR) predicts that if the lockdown is lifted in mid-February, as Prime Minister Boris Johnson hopes, it will have cost the UK £390million every working day.

Business closures mean that output is likely to shrink by more than 4 per cent in the first three months of the year, according to the forecasting group Oxford Economics.

Although the economy should pick up later as the rollout of the Covid vaccine allows shops and restaurants to reopen, experts have already begun to slash their growth predictions for 2021.

Deserted: Carnaby Street in Soho, London, at 11am today which would normally be packed

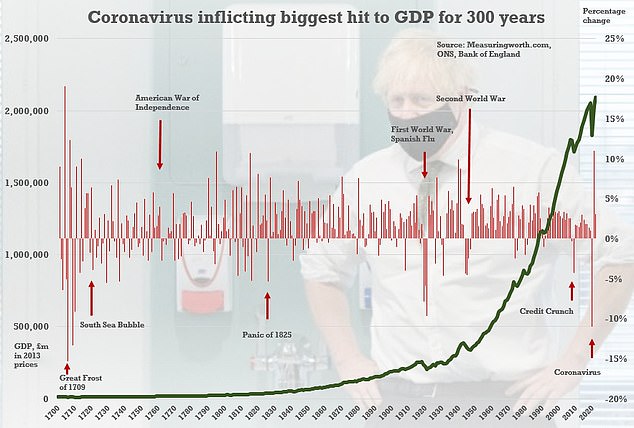

Coronavirus is thought to have inflicted the worst hit to GDP since the Great Frost of 1709

Government borrowing could be close to £400billion this year and is set to continue at eye-watering levels into the mid-2020s as experts warn that a double-dip recession is on the way

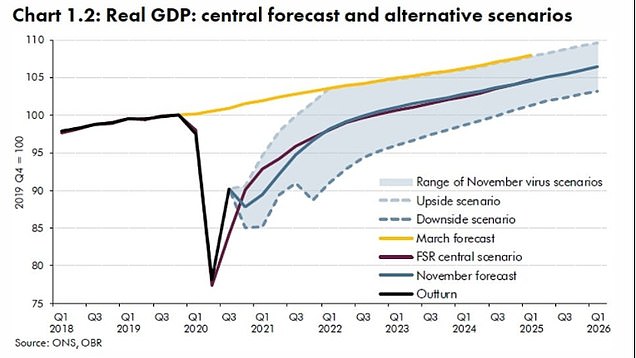

There will be fears that the UK is now tracking the downside scenario set out by the OBR watchdog at the end of November, after mutant coronavirus forced fresh lockdown

Howard Archer, of the EY Item Club economic forecasting group, had previously pencilled in growth of 6.2 per cent for 2021.

But now, given the grim start to 2021, he doubts output – or gross domestic product (GDP) – will grow by more than 5.5 per cent.

Mr Archer said: ‘With restrictions now in place in most areas of the UK, the EY Item Club expects the economy will have a challenging start to 2021 and will likely see modest contraction in the first quarter. This would result in a double dip recession.’

A recession is defined as two consecutive quarters of economic contraction, and a new one would represent the first double-dip recession to hit the UK since 1975, when the banking sector was in crisis and the country was being rocked by a series of strikes.

The pandemic dragged the UK into its first recession for 11 years at the start of last year.

The country had a brief respite in the third quarter as the first lockdown lifted and the Eat Out to Help Out scheme encouraged Britons to spend.

But the economy is expected to have shrunk again in the final three months of 2020 as Covid restrictions were reimposed.

Last month, the Bank of England predicted a 1 per cent decline for the final quarter of 2020. But Mr Archer thinks the fall could be nearer 2 per cent.

Ghost highway: An almost-empty M1 near Leeds at 8.15am earlier today as lockdown begins

Empty streets in Manchester on the first day of new Covid lockdown as people stay at home

Another contraction in the first three months of 2021 will put the UK back in recession.

Allan Monks, an economist at the investment bank JP Morgan, said the third lockdown would ‘hit the economy harder’ than November’s restrictions.

While the drop is lower than the huge GDP fall during last spring’s lockdown, when the economy plummeted by nearly a fifth, it comes as output is still struggling.

Even heading into the third lockdown, the economy is already at around 11 per cent below what it should have been. Concerns over the UK’s lacklustre growth have renewed speculation that the Bank of England could cut interest rates to a minus figure to encourage spending rather than saving.

The Bank’s base interest rate is already at a record low of 0.1 per cent. If it went negative, customers would effectively be paying to keep their money in the bank.

But despite the gloomy forecasts, there are some signs of light at the end of the tunnel. Mr Archer said: ‘We expect the economy to benefit progressively through 2021 from the rollout of the vaccine.’

Mr Monks added: ‘We assume the level of GDP at the end of this year will not be materially lower due to a successful vaccine rollout.’

However, any improvement at the end of the year could come to late for the stationery chain Paperchase, which warned yesterday it was on the brink of collapse, putting 1,500 jobs at risk.

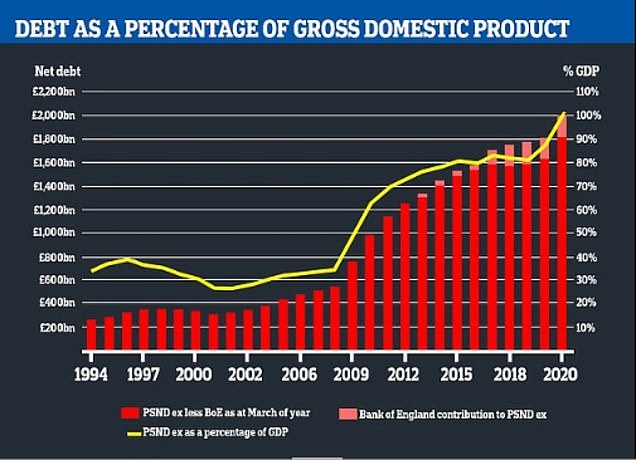

Alarm is growing at the state of the government’s finances, with IFS director Paul Johnson saying the scale of the economic damage was the worst ‘in the whole of history’

Ghost town: Plymouth city centre in Devon was deserted this morning as third lockdown starts

The firm, which has 127 branches, confirmed it had filed a notice to appoint administrators, which gives it protection from creditors for ten working days so it can formulate a rescue plan.

It said the Government’s coronavirus restrictions had put an ‘unbearable strain’ on business, with Christmas closures followed by the latest lockdown proving the final straws.

Paperchase struck a rescue deal with creditors in 2019, but its turnaround hopes were hit by the pandemic. Many stores are in airports and other transport hubs that suffered as commuter numbers plummeted.

The firm’s decision to take steps towards administration follow poor sales in November and December due to widespread store closures.

Those two months alone normally generate two fifths of its annual sales. A rise in online sales was not enough to cushion the blow.

A spokesman said: ‘Out of lockdown we’ve traded well, but as the country faces further restrictions for some months to come, we have to find a sustainable future for Paperchase

‘We are working hard to find that solution. This is not the situation we wanted to be in. Our team has been fantastic and we cannot thank them enough.’

A string of retailers has buckled in the face of the pandemic.

Despite government support of staff furlough, relief from business rates and protections from eviction, Topshop owner Arcadia, department store chain Debenhams and Monsoon Accesorize were among other casualties last year.

And as our City Editor shows, the Chancellor has already racked up a £277billion virus bill

Alex Brummer’s Analysis

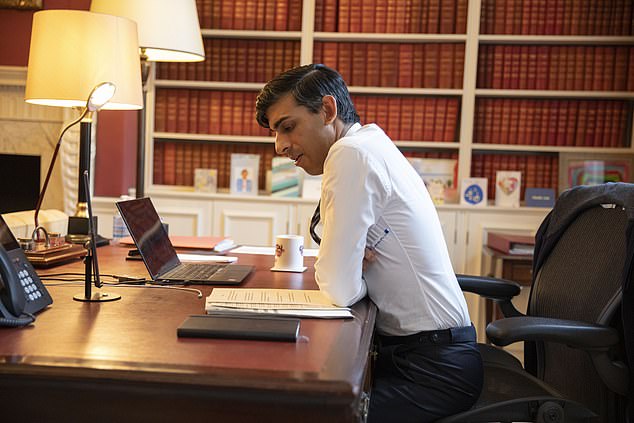

Rishi Sunak is well used to the routine now. For the 13th time since March 17, he’s having to dig deep into the Exchequer in his mammoth effort to keep as many businesses and jobs intact as he can, and to try to limit the long-term damage to Britain’s economic prospects.

By the standards of the vast scale of assistance already in place, the latest intervention is relatively small and carefully targeted at those smaller retail and hospitality businesses in danger of vanishing for ever as the third national lockdown takes hold.

The new bill of £4.6 billion represents just 0.2 per cent of the nation’s total output. It shrinks into insignificance when compared to the vast extra spend of nearly £280 billion on coronavirus support measures that the Chancellor has signed off in the past ten months.

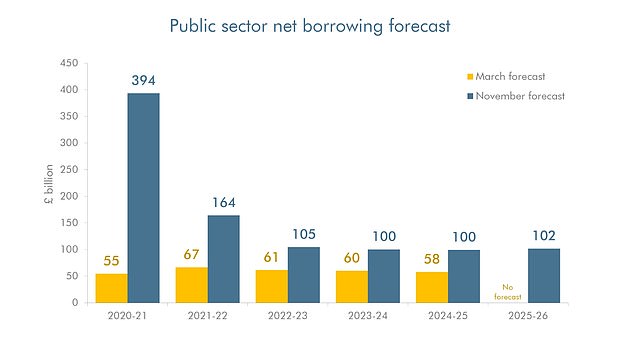

The extra spending together with lost tax revenues means the UK will have to borrow more than £400 billion in the 2020-21 financial year ending in April.

The national debt – that is all the borrowing accumulated over decades – has already soared through the £2 trillion barrier and is now greater than the value of the output of every business and worker in the nation.

As City Editor Alex Brummer shows, Chancellor Rishi Sunak (pictured) has already racked up a £277billion virus bill as leading forecasters predict the economy will shrink by 3% in January

Mr Sunak’s latest measures will only slow the pace of slump, with leading forecasters predicting the economy will shrink by 3 per cent in January and 3.5 per cent in the first quarter of the year, squashing hopes of a rapid bounce-back.

The Office for Budget Responsibility has estimated the average cost of each of the Chancellor’s previous 12 spending packages has been a whopping £22 billion – more than any annual loosening of budgetary policy dating back to the pre-election Budget of 1992.

As well, the Bank of England has expanded its programme of buying Government bonds for cash three times since the first lockdown and has now pumped an extra £475 billion into the economy since March.

The Bank’s policy is designed to support consumption, spending and investment.

So where exactly is the money going?

Public services – £127.1bn

As the pandemic year has progressed, the Government has committed to spending an extra £127.1 billion on public services.

Included in this figure is direct spending on the NHS; the cost of Test and Trace; ordering, buying and distributing vaccines; PPE; extra support for local authorities and social care and for the free school meals scheme championed by footballer Marcus Rashford.

Employment support – £73.3bn

It has been stop-and-go for the employment market since the Chancellor came up with the Covid jobs support scheme – better known as furlough – on March 20.

He renewed the scheme in his Winter Economic Plan in September after previously seeking to phase it out. If this support package – together with a similar scheme for the self-employed – runs until April 30, the cost is estimated at a whopping £73.3 billion.

If, as hinted at by Mr Sunak yesterday, the scheme is extended, it will be even more. The generosity of furlough means the UK’s unemployment level stood at 4.9 per cent of the workforce in December against 8.4 per cent in Europe.

Some 370,000 UK citizens – a record figure – were made redundant in the three months from October to December.

Loans and guarantees – £31.4bn

Operating through the high street banks, the Government has given out £68.2 billion in loans to small and medium-sized businesses.

In addition, the Bank of England has a special loan facility for the biggest public, private and overseas-owned companies operating in the UK.

Many of the guaranteed loans will not be repaid, with an estimated cost to the Exchequer of £31.4 billion.

Experts predict if it’s lifted in February as planned it will have cost £390m every working day

Business support – £36.7bn

The Chancellor has added £4.6 billion to his already expensive package of measures for business and enterprise which has been costed at £34.1 billion.

This includes the tax break on business rates which is scheduled to end on April 27, the cut in VAT for hospitality businesses currently closed, and direct grants to high street firms administered by local authorities.

The big supermarkets have given back £2 billion of suspended business rates after making super-charged profits during the pandemic.

Welfare measures – £8.3bn

The biggest welfare expense has been the £20-per-week temporary increase in universal credit worth £1,000 a year to recipients.

Mr Sunak has also raised the sums that low-income renters can claim in the shape of housing allowances.

The bill for job seeker’s allowance has also climbed as more people join the dole queues.

Altogether the cost of additional welfare payments is projected at £8.3 billion by the end of the fiscal year in April.

The Chancellor is under great pressure from think-tanks and campaign groups to make the extra £20-a-week universal credit a permanent rise.