Coca-Cola sees fall in earnings by 33%, but company hopes improving demand as lockdowns ease

Coca-Cola earnings fall 33%, but company sees improving demand as lockdowns ease

Coca-Cola on Tuesday reported its largest decline in quarterly revenue in at least 25 years, but the company sees demand improving as global lockdowns ease.

CEO James Quincey said the company believes the second quarter will likely be the most challenging of the year.

Shares of the company rose 2% in premarket trading.

Here’s what the company reported compared with what Wall Street was expecting, based on a survey of analysts by Refinitiv:

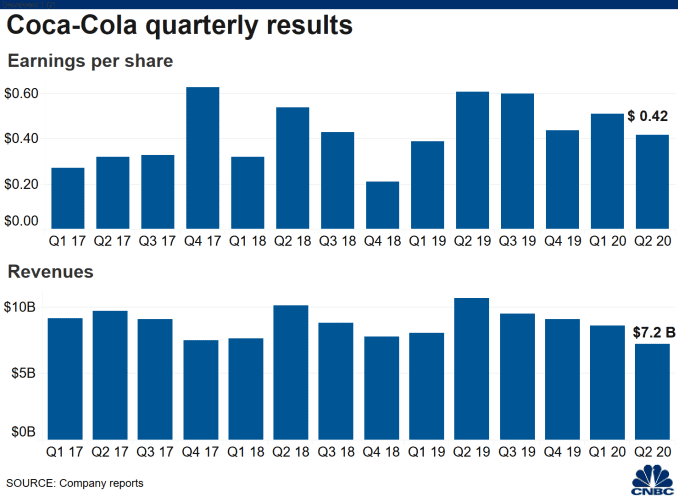

- Earnings per share: 42 cents, adjusted, vs. 40 cents expected

- Revenue: $7.2 billion vs. $7.2 billion expected

Coke reported fiscal second-quarter net income of $1.78 billion, or 41 cents per share, down from $2.61 billion, or 61 cents per share, a year earlier.

Excluding items, the beverage giant earned 42 cents per share, topping the 40 cents expected by analysts surveyed by Refinitiv.

Net salesdropped 28% to $7.2 billion, meeting expectations. Organic revenue, which strips out the impact of currency, acquisitions and divestitures, fell 26% in the quarter.

[amazon box=”B07SDFC9QT” “small”]

Global unit case volume shrank by 16%, although volume trends have shown signs of sequential improvement as global lockdowns ease. After plunging 25% in April, unit case volume fell by just 10% in June. So far in July, volume has fallen by the mid-single digits. The company attributed the change to improvements in its away-from-home sales, which typically make up about half of its revenue, and sustained, higher sales for its at-home drinks.

Sparkling soft drinks’ volume fell 12% in the quarter. Coke’s namesake brand saw volumes decline by 7%, and demand for Coca-Cola Zero Sugar, which had been boosting sales for the brand, fell 4%.

Other drink segments were hit even harder. Tea and coffee volume plunged 31%, largely due to temporary closures of nearly all Costa cafes in western Europe. Water, enhanced water and sports drinks saw volume decline by 24%. Volume of juice, dairy and plant-based beverages sank 20%, although Coke reported strong growth in North America for its Fairlife milk and Simply juices.

As Coke tries to emerge from crisis stronger, it is planning a “refreshed” marketing approach that focuses on spending its marketing dollars efficiently and effectively. The company announced in late June that it would be pausing all social media advertising for 30 days. Coke did not officially join the July advertising boycott against Facebook, which was meant to put pressure on the social media company to crack down on hate speech and misinformation.

The company pulled its full-year outlook in March, citing uncertainty around the coronavirus pandemic.

ReutersCoca-Cola revenue tumbles as lockdowns hammer soda sales

Coca-Cola Co (KO.N) said on Tuesday demand for its sodas was improving after reporting a 28% slump in sales in one of its “most challenging” quarters of the year due to coronavirus-led closures of restaurants, theaters and sports venues.FILE PHOTO: A Coca-Cola truck makes its way through downtown Los Angeles, California, U.S., October 24, 2018. REUTERS/Mike Blake

Shares of the world’s largest soda maker rose about 2% before the bell as it also beat second-quarter profit estimates.

Coca-Cola generates a sizeable portion of its revenues by selling its soft drinks and concentrates to restaurants and theater operators, such as McDonald’s Corp (MCD.N) and AMC Entertainment Holdings Inc (AMC.N), but most of them had to close some or all of their operations due to the health crisis.

The Atlanta-based company said unit case volume trends, a key demand indicator, improved sequentially, from a decline of about 25% in April to a fall of about 10% in June as lockdowns eased.

[amazon box=”B07SDFC9QT” “small”]

Volume trends for the month of July to-date was down mid-single digits globally.

For the June quarter, it declined 16%, with trademark Coca-Cola falling 7% and sparkling soft drinks dropping 12%.

Unit volume of teas and coffees tumbled 31%, largely because of the temporary closure of Costa stores in Western Europe.

Rival PepsiCo Inc (PEP.O) also reported a fall in beverage sales in North America, but a boost from at-home consumption of snacks helped the company beat quarterly revenue estimates.

Coca-Cola reported adjusted revenue of $7.18 billion, largely in line with estimates according to IBES data from Refinitiv.

On a per share basis, Coca-Cola earned 42 cents, beating analysts’ average estimate of 40 cents.

Net income attributable to the beverage maker’s shareholders fell about 32% to $1.78 billion.