When would be the earliest the IRS would send out Biden's proposed $ 1,400 stimulus check if approved? | The State

The IRS still distributes the second stimulus check.

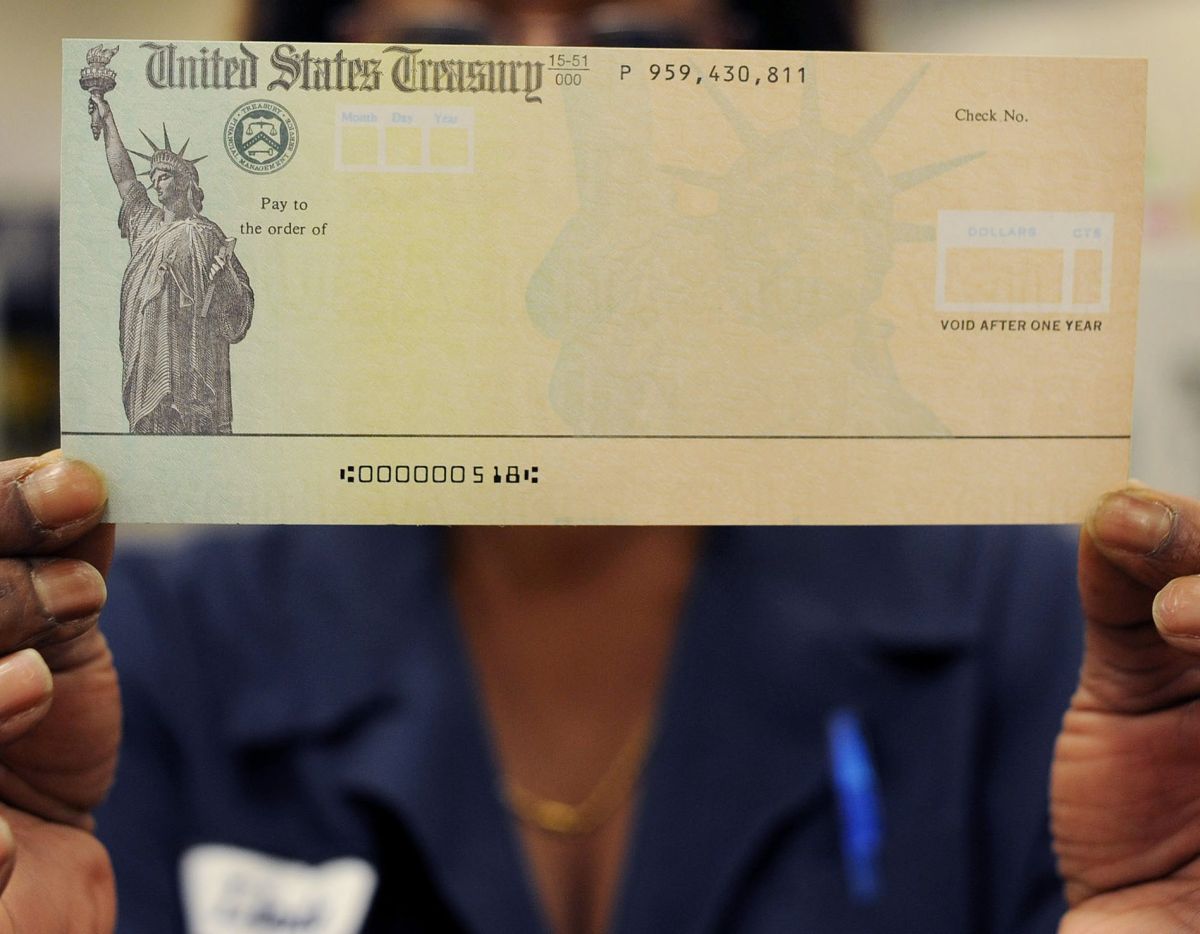

Photo:

William Thomas Cain / Getty Images

If the third $ 1,400 stimulus check proposed by the president-elect Joe Biden is approved in mid-February, the first direct deposits with the money should reach the beneficiaries at the end of the same month.

Some financial analysts like Alec Phillips of Goldman Sachs anticipate that Biden’s plan for a third round of stimulus checks would be a reality between mid-February and mid-March after legislation to that end is approved by both the House of Representatives. Representatives as per the Senate and signed by Biden.

In the event that new legislation is approved by the end of March, it would not be until April that recipients would see their payments.

Biden announced last week his proposal to grant new direct payments to Americans affected by the pandemic. However, while Democrats will have a majority in both houses, the measure must be endorsed by both Democrats and Republicans to become law.

The measure arises when even the Internal Revenue Service (IRS) and the Treasury Department finalize – in theory – the distribution of the second stimulus check under the stimulus bill passed in December.

Second round

As part of the current round provisions for payments of $ 600 minimum, the law established a date of January 15 as the deadline for these agencies to complete sending payments in most cases.

However, information on the IRS ‘own website indicates that the arrival of payments by mail can take between 3 to 4 weeks.

First round

In the first round of distribution under the CARES law Approved in March, the first deposits to bank accounts began to be reflected in mid-April, about three weeks after President Donald Trump signed it.

This count does not include the millions of cases of people who do not file taxes, so the IRS does not have information to process them and the process was delayed or never started

Due to that and other issues, some recipients who are creditor of the payment have not yet received it.

Eligible Americans who do not receive the current payment, the first round payment, or both, must request it through the process known as “Payment Trail” or as a credit on their next tax return.

.