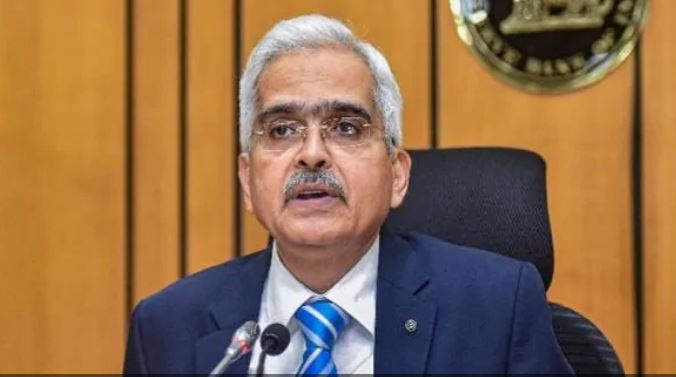

Three months discount on cheaper loan-EMI, RBI opens doors of relief in corona crisis

In the midst of the lockdown, the Reserve Bank has cut the repo rate as expected. This reduction in the repo rate is the biggest in RBI history.

In the midst of lockdown, efforts are being made continuously by the government to boost the country’s economy. Under this, the Reserve Bank has also opened the doors of relief. The RBI has cut the repo rate by 75 basis points. After this reduction, the repo rate has come down from 5.15 to 4.45 per cent.

At the same time, people giving loan EMI from banks have been advised up to 3 months of relief. Please tell here that the RBI has given advice, not just the order. This means to say that now the ball is in the court of the banks. Understand in easy language, now the banks have to decide whether they are giving a discount on EMI to the common people.

With this, only the banks will decide which loan they are giving EMI exemption. This means that there is still a kind of confusion for people taking retail, commercial or other types of loans.

– However, RBI’s decision to cut the repo rate is historic. This deduction is the biggest in RBI history. Explain that in the last two monetary review meeting, the RBI had not taken any decision regarding the repo rate.

– The benefit of the repo rate reduction is expected to be available to crores of people who fill many EMIs including home, car or other types of loans. With this, the customers taking new loans will also get benefit. With this, the RBI has also reduced the reverse repo rate by 90 basis points to 4 percent.

However, the RBI has not released figures on GDP growth rate and inflation rate, this is the first time that the RBI has not presented the figures.

RBI Governor said that the cash reserve ratio (CRR) has been reduced by 100 basis points to 3 percent. This has been done for a period of up to one year.

According to the RBI governor, all commercial banks are being given a 3-month exemption to pay interest and loans. With this decision, cash of Rs 3.74 lakh crore will come in the system.

-RBI Governor has also advised people about digital banking. He also said that the banking system is safe and strong.

PM Modi said big step

PM Narendra Modi has said the decision of RBI is important for the economy. He said that the RBI has taken big steps to protect our economy from the effects of coronavirus. These announcements will improve liquidity, save, help the middle class and business class

Package has been announced for the poor

It is worth noting that amid a 21-day lockdown, Finance Minister Nirmala Sitharaman announced a special package of 1.70 lakh crore for the poor on Thursday. Through this package, efforts have been made to provide relief to the farmers, laborers and women, besides the elderly, widows and the disabled. But the government did nothing about the middle class.